April 4, 2025, dawned with the deceptive serenity of an ordinary Friday, only to unravel into a tempestuous spectacle that rattled Wall Street to its core. As the opening bell sang out its customary invitation to trade, few could have predicted the pandemonium that would ensue. By the time the day staggered to a close, the Dow Jones Industrial Average had spiraled downward by over 2,200 points—a visceral descent of about 5.5%. Its companions in economic woe, the S&P 500 and the Nasdaq, mirrored the somber ballet, each cascading nearly 6%. This financial Shakespearean tragedy played out against the backdrop of escalating trade tensions, spotlighted by China’s audacious announcement of increased tariffs on U.S. imports, an overture that sent dissonance reverberating through global financial markets.

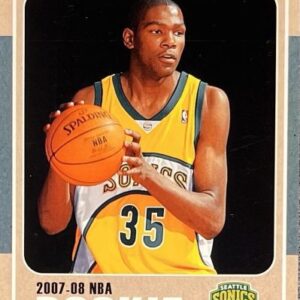

However macabre the financial choreography might appear to some, others turned their focus to a seemingly distant yet surprisingly connected world: the trading card industry. It’s a curious world where ageless paper rectangles adorned with athletes’ visages have enjoyed a renaissance of adoration and investment akin to Renaissance art. With values of trading cards skyrocketing in recent years and record-breaking sales seemingly a common occurrence, collectors and investors have fostered reverential awe for stars such as Shohei Ohtani, Aaron Judge, and Mike Trout, along with their iconic rookie cards. What was once dismissed as childhood ephemera has metamorphosed into a siren call for collectors and investors alike.

Yet, as today’s financial tragedy unfolded, the ripple effects raised an essential query: How will this economic unease reshape the horizon for trading card collectors and investors caught in the crossfire of such market turmoil?

Historically, sunshine always follows rain, but economic downturns cast lengthy shadows, compelling consumers to reassess and often tighten their spending habits. Consumer confidence, it turns out, plays its own complex game of the stock market, rising and falling with global events. With confidence waning as wallets tighten, a contraction in discretionary spending seems as imminent as Wall Street’s post-crash introspections. Higher-end trading cards and expensive collectibles risk abandonment to the ranks of frivolous luxuries out of reach, their demand dangerously close to following fortunes down precarious paths. This could potentially usher in a period of price corrections after what has felt like an endless bull run, presenting unforeseen challenges to those who thrived under brighter economic skies.

There is, however, something to be said about the adaptability of human nature in the face of chaos. Just as a ship seeks safe harbor amid violent storms, so do investors occasionally venture into the tangible and alternative, into havens that promise security amid tumult. Enter the trading card—once more the hero of our narrative, standing steadfast against the onslaught. Historically, the value of rare collectibles and cherished memorabilia has not only withstood previous economic slumps but often thrived within them. Trading cards, especially those that are limited edition or graded, might attract investors eager to hedge against further market instability, marking them as potentially valuable assets.

The months ahead portend a period of significant flux for the trading card market, where broader economic developments and shifts in consumer confidence will dictate the tempo. Collectors and investors alike must tune their instincts to the subtleties of this evolving landscape, particularly monitoring how market sentiments shift and sway. Whether this economic drama is a fleeting interlude on the path back to bullish glory or the first act of a prolonged market recalibration, the implications for the trading card industry will be momentous.

As Wall Street grapples with finding its balance, steadied by the supportive cane of cautious hope, the trading card community must gear up for a potentially rollicking ride. While the immediate road might seem pitted with unprecedented challenges, opportunity often disguises itself in such chaos for those who are keen-eyed and prepared to seize the day. Those willing to weather these storms, armed with strategy and patience, might find themselves richly rewarded, perhaps seeing not just stability, but prosperity beyond the tempest’s reach.