April 4, 2025, will be recorded as no ordinary day on Wall Street. It played out with the kind of intensity that would make seasoned traders instinctively clutch their spreadsheets tighter. A colossal shakedown, with all the unscripted drama only high-stakes financial dealings could brew. In the crosshairs of the falling market, the Dow Jones Industrial Average stood perilously jostled, cascading downward by over 2,200 points—a veritable nosedive of around 5.5%. Not ones to be left out of the action, the S&P 500 and the Nasdaq also indulged in the cliff-diving contest, plummeting nearly 6% each. Why all this commotion? The instigator lies on the other side of the Pacific, where China’s freshly minted, robust tariffs on U.S. imports have served a potent cocktail that sent shockwaves through an already jittery global financial market.

But amid all these tectonic shifts in numbers and forecasts, there lies a refreshingly bewildering question revolving around a realm usually detached from the tumult of Wall Street: What does all this financial ferocity spell for the trading card collectors and investors who have, of late, ridden a wave of unparalleled prosperity?

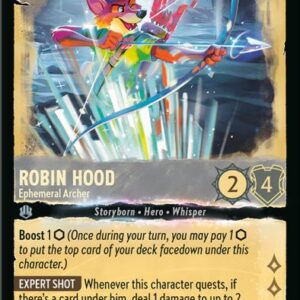

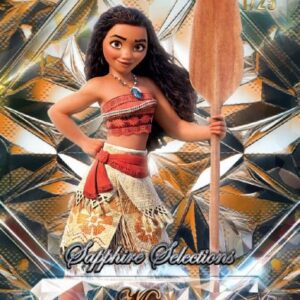

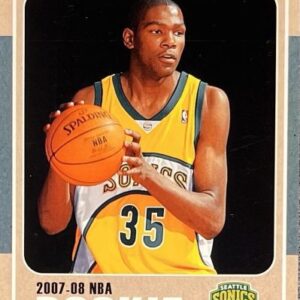

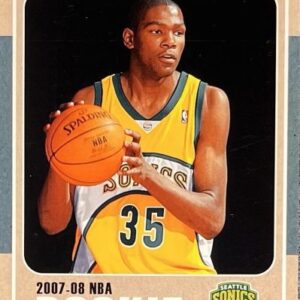

Strange as it may sound, the trading card industry has thrived lately with an unexpected leap into prominence and profitability. Cards bearing the triumphant visages of baseball’s trailblazers—Shohei Ohtani smirking over a victorious sweep, Aaron Judge sizing up a homerun pitch, Mike Trout’s decisive stride toward greatness, and rookies who are perpetually shrouded in future promise—have shed their status as mere memorabilia. Instead, they have metamorphosed into financial meteorites, sizzling through the stratosphere of market heights. But, there’s the rub: with Wall Street’s current whirlwind, are these shiny cardboard dreams at risk of turning into so much paper ash?

Economic downturns do not exactly stimulate consumer spending confidence. Just consider, the term “tightening of purse strings” was not coined out of thin air. This decline could prompt a deceleration in expendable cash going towards high-end trading cards and collectibles, thereby introducing a pause, if not a plunge, in the prolific gains these markets have recently enjoyed.

However, the market is quite the stage for unpredictable performers. Volatility has been known to direct investors towards alternatives—exits of sorts—into tangible assets like trading cards. In the past, when financial squalls howled and terrified the traditional corridors of investment, rare collectibles and elite memorabilia held their ground, even appreciating in value. Investors tempted by the durability and allure of cards, particularly limited-edition and graded gems, may still pine after these treasures as fortifications against fiscal nightmares and portfolio instability.

What’s certain is that the upcoming weeks and months could very much usher in waves of volatility across the trading card market. Like a ship bracing for stormy open waters, collectors and investors must pay heed to the signals—be it economic markers, shifts in consumer confidence, or the broader sentiment that plays out in the streets of the financial district. Understanding whether this downturn is but a hiccup or a herald of more permanent trends to come is crucial in navigating these choppy waters.

As the dust begins to settle—or expand as it were—around Wall Street’s tumult, the trading card diaspora should stand ready. For though the road may indeed jitter with unpredictable twists, it could simultaneously unveil prospects where shrewd eyes insightfully identify and seize golden opportunities. As ever, fortune favors those astute enough to read the currents beneath the surface of numbers—a fitting blend of economics, nostalgia, and investment acumen, rolled into every card flipped, traded, and cherished. And who knows? History may yet mark this period not just as a jolted trader’s trial, but as the era where trading cards, once a child’s plaything, danced with destiny as the delight of investors.