Beckett Grading Services (BGS) finds itself mired in turbulent waters as its once dominant foothold in the sports card grading realm continues to erode. Recent data from grading analytics platform GemRate paints a grim picture, with BGS grading a mere 32,000 cards in November, marking a significant 32% drop compared to October and a troubling 43% decline year-over-year. These numbers signal a deepening crisis for Beckett, which had seen a less severe 13% decline year-over-year back in August.

Adding fuel to the fire are the legal woes swirling around Greg Lindberg, the owner of Beckett’s parent company. Lindberg’s involvement in a $2 billion insurance fraud scheme has cast a shadow of doubt over the financial stability of the company. Revelations from court filings expose a precarious situation, where Lindberg leveraged a hefty $100 million loan against Beckett Grading Services, yet the company reportedly only received a mere $500,000 from this transaction. This mismanagement has raised concerns about Beckett’s ability to weather the storm, with the specter of liquidation looming large as Lindberg’s assets face scrutiny.

The credibility crisis triggered by these revelations has sent shockwaves through collector circles, exacerbating the challenges Beckett faces in retaining its competitiveness in an increasingly cutthroat grading industry.

While facing scandal, Beckett also grapples with a changing market landscape. Despite a period of robust growth in the sports card grading sector, Beckett has failed to capitalize on the industry’s upward trajectory. Among the prominent “Big Four” grading companies, BGS stands out as the lone player experiencing a decline:

– PSA: Registers a 12% year-over-year increase.

– SGC: Shows steady growth with a 7% rise year-over-year.

– CGC Cards: Booms with a substantial 32% surge year-over-year.

Beckett has now slipped to fourth place, lagging behind CGC, which traditionally focused on TCG and non-sport cards. Notably, CGC surpassed Beckett in sports card grading in November, despite sports cards constituting only 13.1% of CGC’s total output, while they make up a more significant 60% of Beckett’s volume. This shift underscores Beckett’s struggles even within its core domain.

While Beckett has maintained some relevance through its Black Label 10s and Pristine 10s, which fetch premium prices in collector circles, particularly among TCG enthusiasts, this niche strength is insufficient to offset losses in high-volume grading. Additionally, heightened promotional efforts by competitors have further diverted attention from Beckett’s offerings, with its relatively high pricing deterring potential customers even amid a promotional push during the Thanksgiving season.

An area of particular concern is Beckett’s declining presence in grading iconic cards. Formerly a go-to choice for collectors seeking assessments of legendary cards such as the 1952 Mickey Mantle and the 1989 Upper Deck Ken Griffey Jr., Beckett’s activity in grading these marquee items has dwindled, as indicated by GemRate’s Iconic Tracker. This downward trend signifies a broader loss of momentum in areas where Beckett once thrived.

Amidst these challenges, Beckett does shine in certain niches:

– High-End Basketball Cards: Beckett continues to attract demand for premium basketball cards.

– TCG Grading: Its focus on Black Label ratings keeps it relevant in the TCG market.

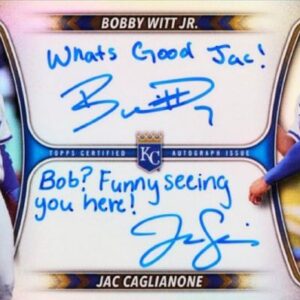

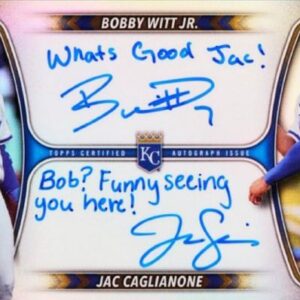

– Topps Now Cards: Beckett has seen success in grading limited-release cards, albeit with a slip in momentum noted in November.

Looking ahead, Beckett Grading Services faces a daunting road ahead, marred by legal troubles and an increasingly competitive landscape. The surging success of rivals like PSA, SGC, and CGC underscores Beckett’s struggle to adapt during a period of industry boom. While its reputation for top-tier grades remains a draw in niche markets, the overall decline in grading volume suggests underlying systemic issues that need addressing.

The future hangs in the balance. Can Beckett pivot, restructure, and reclaim its standing, or will it continue its downward trajectory? Collectors and industry observers will be keenly monitoring to see if Beckett can navigate through the storm and emerge stronger from the trials it faces.